Tunis Re’s compliance with the MSI 20000 financial standard has just been reaffirmed.

This certification, renewed in September 2021, supports the financial credibility of the company and opens new opportunities abroad.

Actualités

Comments on Tunis Re’s activity at 30 September 2021

Comments on Tunis Re’s activity at 30 September 2021

Voir plus

Indicateurs & Commentaires sur l’Activité de la Société Tunisienne de Réassurance « Tunis Re Au 31 Décembre 2020

Indicateurs & Commentaires sur l’Activité de la Société Tunisienne de Réassurance « Tunis Re Au 31 Décembre 2020

Voir plusIndicateurs & Commentaires sur l’Activité de la Société Tunisienne de Réassurance « Tunis Re Au 31 Décembre 2020

Indicateurs & Commentaires sur l’Activité de la Société Tunisienne de Réassurance « Tunis Re Au 31 Décembre 2020

Voir plus

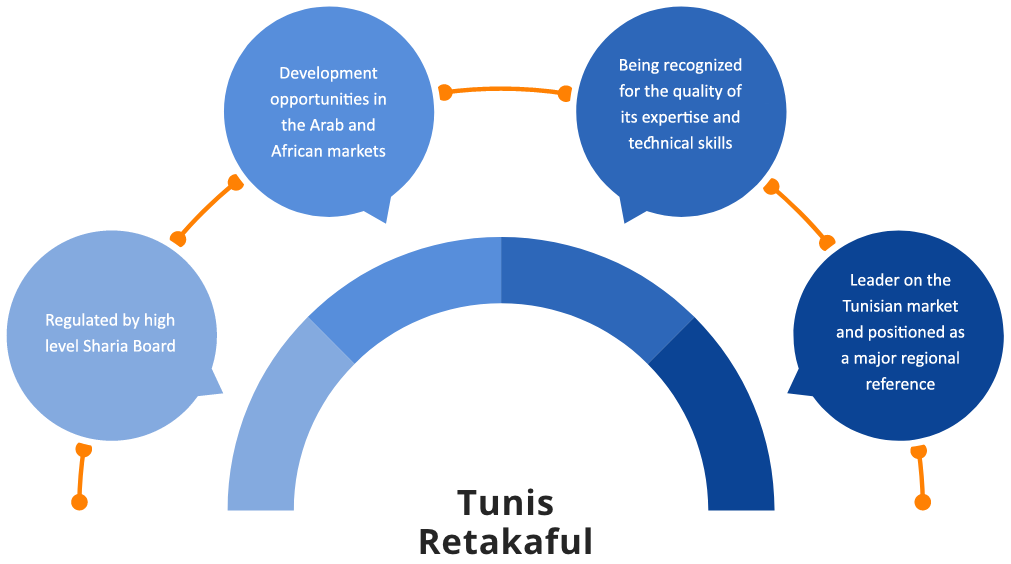

Tunis ReTakaful Window was created in January 2011 to offer a variety of shari’a compliant Retakaful products that meet the needs and requirements of Takaful operators.

Tunis ReTakaful is the first and only retakaful entity established and operating on the Tunisian market. Tunis Retakaful is licensed by the General Insurance Committee to provide comprehensive retakaful services.

The company conducts all its operations strictly in accordance with Sharia principles, as advised by its Sharia Supervisory Committee. It also appointed an independent Sharia auditor to ensure compliance with Sharia principles.

With over ten years of experience, our clients benefit from our underwriting expertise and an in-depth knowledge of takaful insurance. We are flexible to identify and implement Sharia-compliant solutions, which help our partners to be competitive in their target markets.

Our takaful model is a Combined Model – Wakala for underwriting and Mudharaba for investment.

Shariaa Advisor : Mr Mohammed Anouar Gadhoum

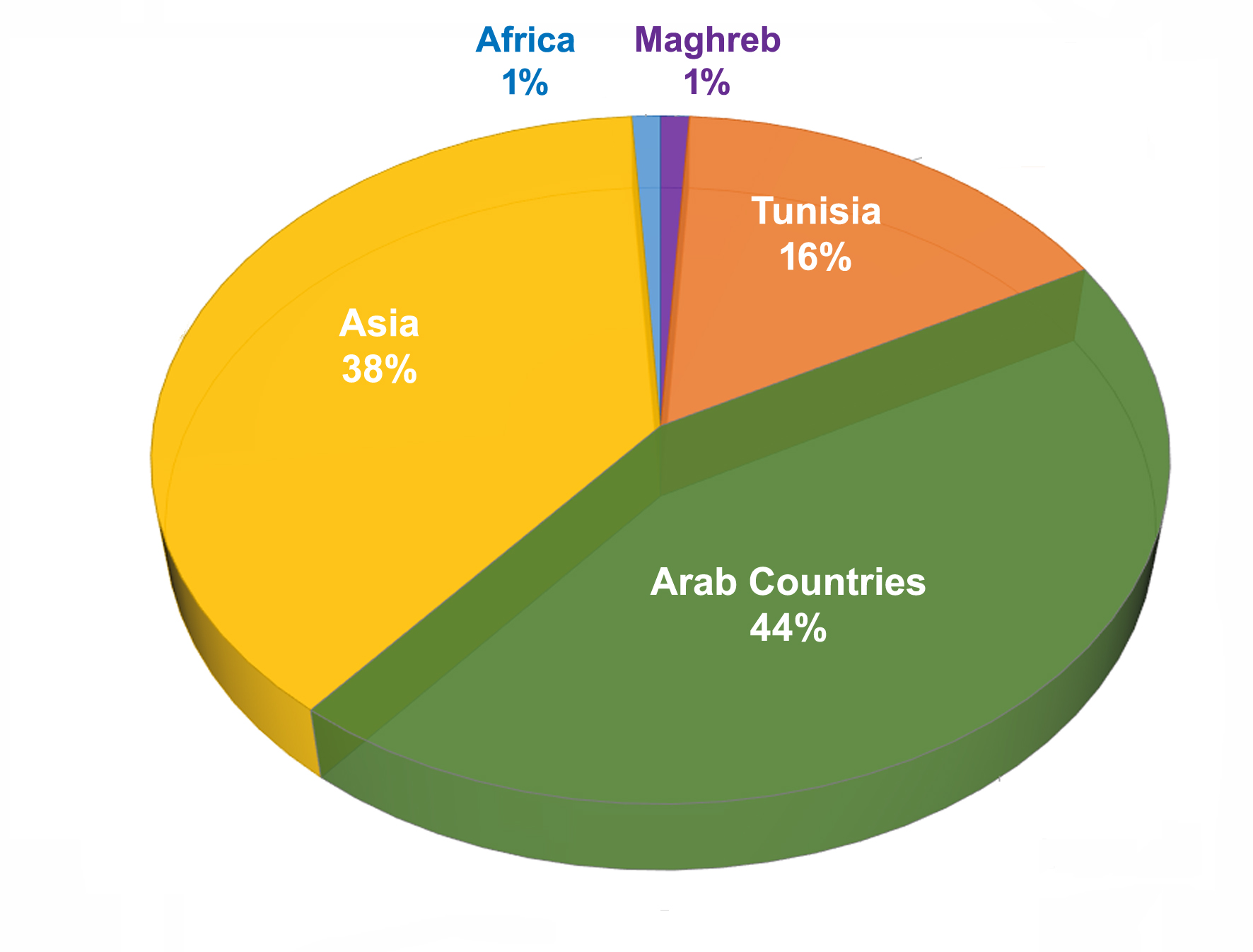

Territorial scope (2024)

- Tunisia

- Arab countries

- Maghreb

- Africa

- Asia

Underwriting Capacities

| TUNISIA | ETRANGER | |

|---|---|---|

| Non Marine (Incendie, Eng & ARD) |

10,000,000 TND / Traité | 2,500,000 US$ / Traité |

| Marine | 2,500,000 TND / Traité | 3,000,000 US$ / Traité |

| Vie | 2,500,000 TND / Traité | 1,000,000 US$ / Traité |

| RC & RC Professionnelle |

3,000,000 TND / Traité | 1,000,000 Usd / Traité |

Treaty capacities

Facultative capacities

| TUNISIE | ETRANGER | |

|---|---|---|

| Non Marine (Incendie, Eng & ARD) |

60,000,000 TND / Risque | 12,000,000 US$ / Risque |

| Marine | 10,000,000 TND / Risque, Police & Ou Expédition | 3,700,000 US$ / Risque, Police & Ou Expédition |

| Energie | 20,000,000 TND / Risque | 6,000,000 US$ / Risque |

| Vie | 2,500,000 TND / Risque | 1,000,000 US$ / Risque |

| RC & RC Professionnelle |

3,000,000 TND / Risque | 1,000,000 US$ / Risque |

FIDAC: Fund for the Compensation of Agricultural Damages caused by Natural Disasters

The 2018 Finance Law, under the Law No. 66 of 18 December 2017, created a special fund to compensate agricultural damages caused by natural disasters. These include mainly storms, floods, ice, droughts, wind and snow which are not covered by the standard insurance contract provided by insurance companies. The objective is to protect and develop farmer’s resources to cope with climate change. The fund is financed by an annual state contribution of around 30 million dinars, a solidarity tax of 1% of direct and indirect income in the agricultural sector, and a membership contribution of 2.5% of the farmers’ or fishermen’s production costs or the estimated value of production, depending on their choice. The management of the fund has been attributed to the Tunisian Agricultural Mutual Insurance Company CTAMA.

Natural Disasters

A survey has been launched on Natural Catastrophes in Tunisia. The Tunisian government, with the support of the World Bank, is committed to develop and implement a standardised and institutional framework for the management and financing of natural disaster risks in Tunisia.